Source: Yahoo Finance

Inflation Picture in August

India’s inflation numbers for August came in almost exactly as expected. Headline retail inflation stood at 2.07%, rising slightly from the previous month but still far below the mid-point of the central bank’s comfort zone. The biggest influence was food, where prices decreased by 0.69% compared to the same period a year earlier. Vegetables alone were nearly 16% cheaper than they were last year, helping to offset the costlier items like meat, fish, and cooking oil.

Economists had expected this modest rise, and the underlying trend also looks stable. Core inflation, which leaves out volatile items such as food and fuel, stayed at 4.1%. That suggests demand in the economy is not picking up dramatically despite India’s overall growth.

What It Means for the RBI

For now, the Reserve Bank of India is expected to hold interest rates steady. But many analysts see room for cuts before the end of the year. They also expect that if growth weakens further and the U.S. Federal Reserve moves ahead with its own rate cuts, the RBI may follow with a reduction of 25 to 50 basis points in December.

Still, there is a place for caution. Economists say the RBI will want to balance the soft inflation outlook with risks from weather disruptions and global trade tensions. Floods in some regions could push up food prices later this year, though most believe the impact will be manageable.

The Fiscal and Trade Backdrop

The government’s decision to cut taxes on food and household goods is expected to lower prices further in the coming months. That is good news for consumers but less positive for the government’s balance sheet, especially since the tax revenues are already running behind target, and slower GDP growth will make the shortfall harder to cover.

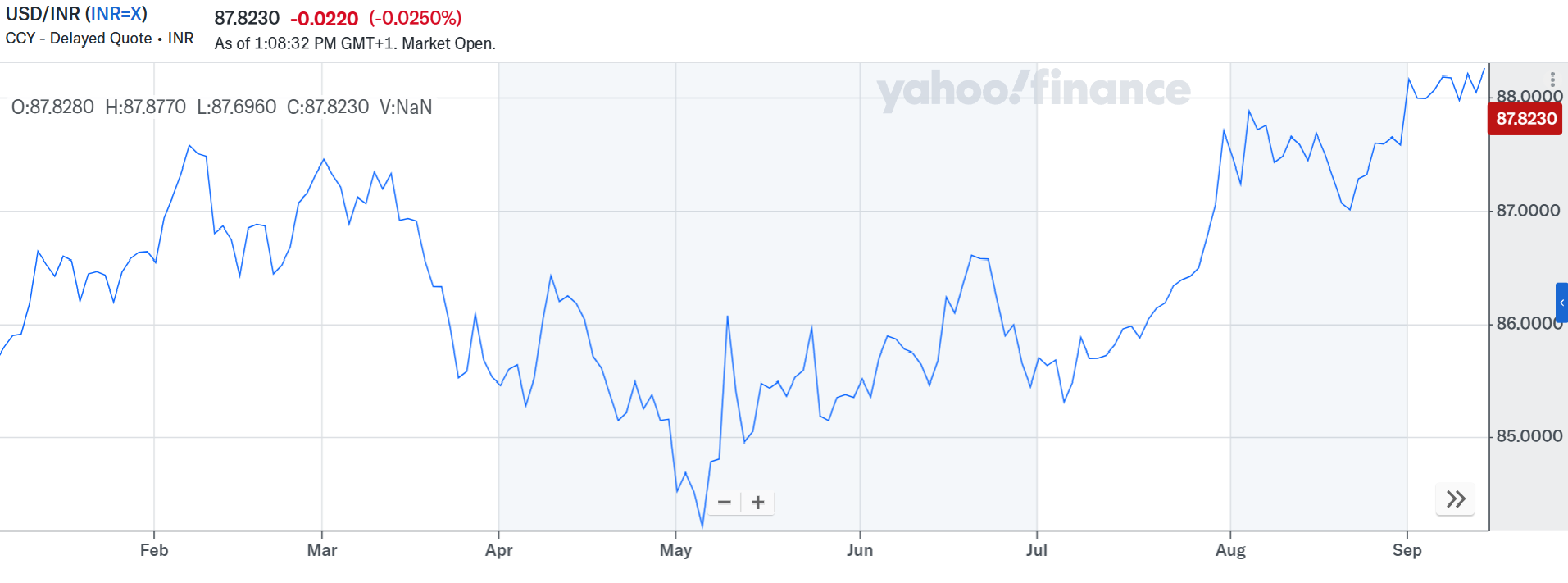

On the trade front, India faces pressure from higher U.S. tariffs on exports. The measures have weighed on corporate earnings and added to rupee volatility. The currency has struggled against the dollar for weeks, reflecting both capital outflows and global uncertainty.

Even so, India’s growth outlook remains stronger than most. The economy is expected to expand by 6.5% this year, the fastest among major economies. Economists say this resilience, along with tax relief measures, could help soften the blow from external shocks.

Indian Rupee looks to the U.S. dollar

The rupee ended last week slightly stronger at 88.2750 against the dollar, helped by expectations of U.S. rate cuts. But traders say the currency remains under pressure from trade disputes and foreign fund outflows. The RBI has been active in smoothing volatility but is not defending any particular level.

A weaker dollar globally has lifted many Asian currencies in recent weeks. If the Federal Reserve follows through on further cuts, India could see capital inflows that support the rupee. At the same time, heavy rains and crop damage remain a wild card for food inflation, which could influence both currency markets and monetary policy.

For now, the picture is one of stability on the inflation front, with plenty of uncertainty around growth and trade. Economists agree that the coming months will be about fine-tuning policy between supporting demand at home and staying resilient in a shifting global landscape.