Source: Trading Economics

Rising Prices and the Rate Dilemma

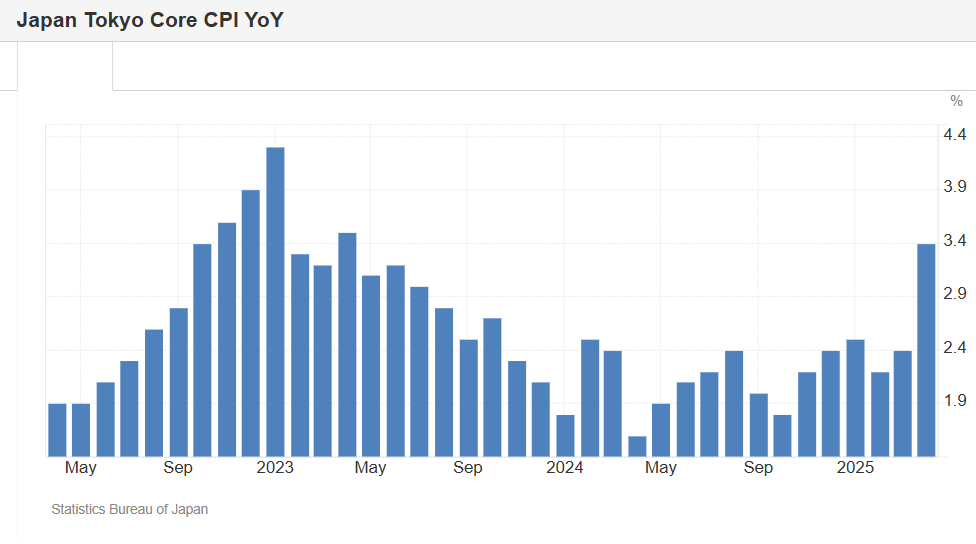

Japan's core inflation in Tokyo climbed to 3.4% year-on-year in April, the highest level in two years. General core inflation, a measure closely watched by the BOJ, accelerated to 3.1%, up from 2.2% in March. This unexpected surge is largely due to reduced government subsidies for energy and a wave of food price hikes that began with the start of Japan’s fiscal year which starts on April 1. While the BOJ had managed to bring inflation closer to its long-standing 2% target after it peaked in early 2023, the current price rebound signals a potential reversal of that trend.

The governor of the central bank, Kazuo Ueda, has signaled a cautious readiness to continue raising interest rates if underlying inflation moves toward the 2% target. However, with current price increases driven largely by cost-push factors rather than consumer demand, further tightening poses risks, especially for households and small businesses. At its upcoming meeting (April 30–May 1), the BOJ is widely expected to hold its short-term rate steady at 0.5%, choosing to wait for clearer data before proceeding. Since Japan moves away from its historic stimulus measures, the central bank must carefully balance inflation control with the risk of undermining growth.

U.S. Tariffs and Domestic Countermeasures

One of the biggest external problems complicating Japan’s monetary policy is the reintroduction of protectionist U.S. trade measures. As we’ve covered extensively in our previous articles, President Donald Trump’s latest tariffs include a 25% duty on Japanese car and truck imports and a blanket 10% tariff on all Japanese goods, temporarily reduced from an originally announced 24% for 90 days. These measures pose a direct threat to key export industries like automotive and steel, prompting the IMF to cut Japan’s 2025 growth forecast from 1.1% to 0.6%.

In response, Prime Minister Shigeru Ishiba has introduced an emergency economic package aimed at shielding both households and industries from the impact of tariffs. The plan includes fuel and electricity subsidies as well as expanded access to low-interest loans for small and mid-sized businesses. While these measures may provide short-term relief, they are unlikely to fully offset the broader economic risks tied to trade disruptions and cooling global demand. If the trade conflict escalates further, the government will likely be forced to introduce additional support aimed at boosting domestic consumption and protecting vulnerable sectors.

Cautious Optimism in an Uncertain Outlook

Although inflation has moved Japan closer to its 2% target after years of persistent deflation, the next steps remain highly uncertain. Japan has had troubles with deflation for the past decade, therefore, current inflation even above target is a partial relief. On the other hand, Japan will eventually need to tame it back to the target of 2%. This positions the central bank in a unique position where its steps will be monitored very closely by global markets.

Yet despite these challenges, Japan’s economy has shown surprising resilience. Its financial system withstood the shocks of the covid pandemic, the 2022 market slowdown, and most recently, renewed global instability. This strength gives policymakers the flexibility to proceed with caution while maintaining public confidence. Going forward, the BOJ's success will depend on its ability to assess inflation trends objectively, communicate its strategy clearly, and adapt gradually toward policy normalization, all without compromising stability in an increasingly unpredictable global environment.