Source: Reuters

Factory Output Hits Eight-Month Low

China’s industrial production rose 5.7 % year-on-year in July, the slowest pace since November 2024 and below June’s 6.8 % growth. The result also missed analysts’ expectations for a 5.9 % gain, reflecting waning momentum in manufacturing despite a temporary trade truce with the United States.

While some high-tech and strategic sectors such as shipbuilding, aerospace, and rail equipment still attracted substantial investment, overall output was constrained by low demand and persistent factory-gate deflation.

Retail Sales Show Signs of Slowdown

Retail sales, a key indicator of consumer activity, increased by just 3.7% in July, down from June’s 4.8% and missing forecasts of 4.6%. Weak household sentiment, hit by falling property prices and job security concerns, continues to weigh on spending.

Officials warn that excessive price competition among domestic producers is also holding back consumption, as shoppers delay purchases in anticipation of further discounts.

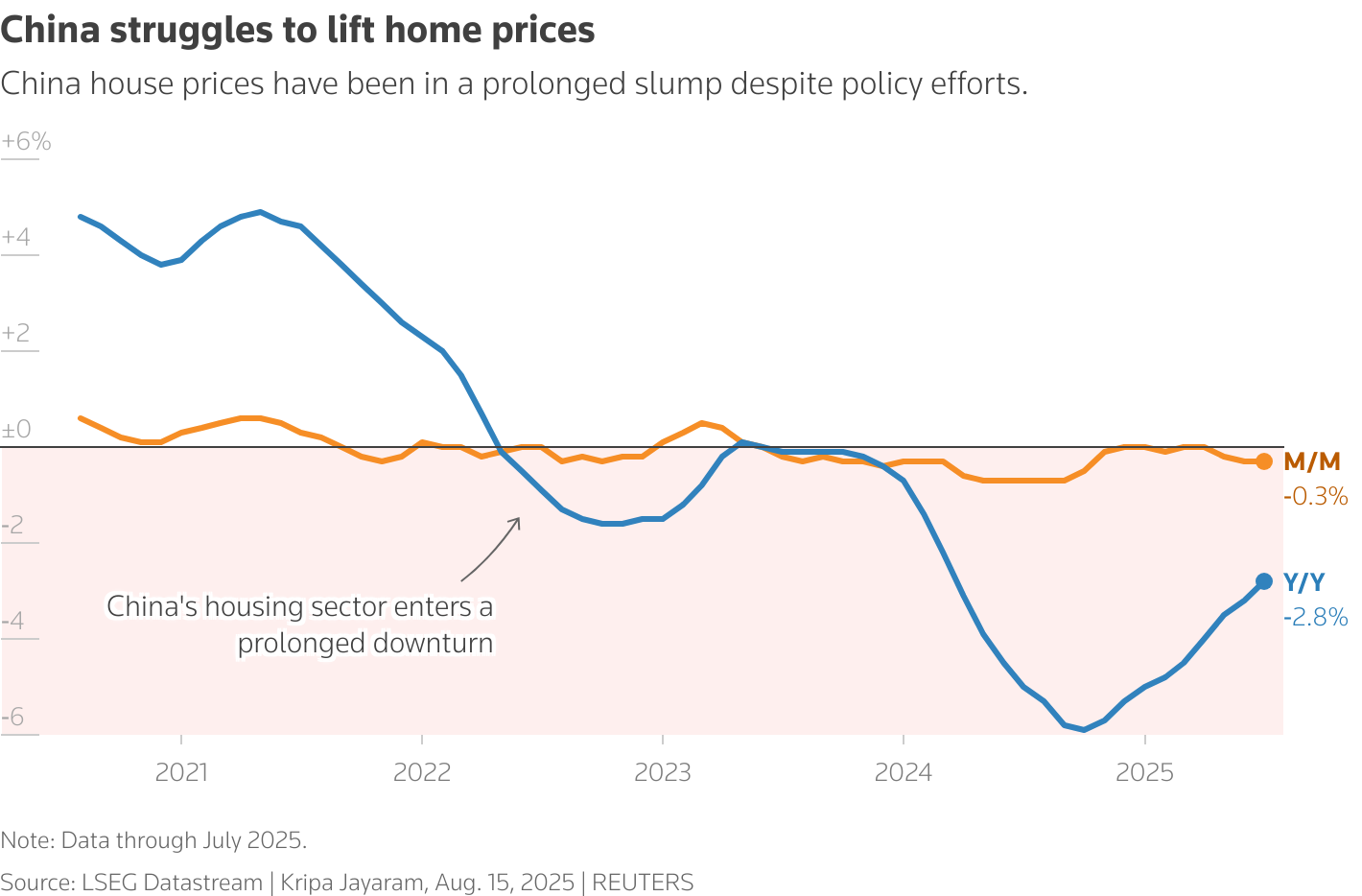

Property Sector Remains a Problem

China’s long-running real estate slump deepened in July. New home prices fell 2.8% year-on-year, continuing a more than two-year downward streak. Property investment in the first seven months of 2025 fell 12% compared to the same period a year earlier, while sales by floor area declined 4%.

The downturn in the sector that used to be a quarter of China’s GDP has undermined household wealth and confidence, prompting Beijing to introduce targeted measures such as subsidies for buyers and relaxed rules for housing fund use. However, analysts say a decisive turnaround remains elusive.

Cooling Growth Outlook

The latest data has prompted economists to scale back expectations for China’s 2025 economic performance. Reuters polls now forecast GDP growth of 4.6% for the year, below the government’s “around 5%” target, with further slowing to 4.2% in 2026. Growth in the third and fourth quarters is expected to weaken to 4.5% and 4.0% respectively. Analysts point to fading fiscal stimulus, ongoing property market weakness, and global geopolicy, including U.S. trade policies under President Donald Trump as key risks.

Policy Response and Market Reaction

Beijing has pledged to strengthen domestic consumption, curb excessive competition, and support strategic sectors. The government is also signaling readiness for more targeted property market interventions, though recent Politburo meetings have avoided committing to large-scale fiscal expansion.

Markets reacted cautiously to the July figures, with Chinese blue-chip stocks edging 0.5% higher while Hong Kong shares fell 1.1%.

.jpg)