The core driver is AI infrastructure. Hyperscalers and server manufacturers are ordering more DRAM and SSDs for AI clusters than the market can produce, and major chip makers now warn that tightness in DRAM and SSD could persist into 2027. At the same time, AI accelerators need large HBM stacks, but only a handful of suppliers (Micron, Samsung, SK hynix) can make HBM at scale, and new lines take years and billions of dollars to ramp.

Pricing data show how extreme the imbalance has become. Counterpoint and other researchers estimate server DRAM prices are already about 50% higher year-to-date and could rise another ~30% into early 2026, with some DDR5 server modules potentially costing roughly twice as much by the end of 2026 as they did at the start of 2025. Consumer markets are feeling this too: RAM and SSD prices have spiked, microSD and high-capacity HDDs are going out of stock in some regions, and PC builders report sharp component inflation driven “of course, by AI.”

Large pre-purchase deals by leading AI players further tighten supply. One analysis of OpenAI’s long-term wafer agreements with Samsung and SK hynix suggests that a single AI partnership could lock up a material fraction of global DRAM output, leaving less flexibility for the rest of the market.

Micron’s leverage to the shortage

Micron is positioned directly in the slipstream of this AI-driven memory cycle. S&P Global Ratings just revised its outlook on Micron’s BBB- credit rating to “positive”, citing increasing scale, higher EBITDA and structurally faster growth from AI demand. Micron closed fiscal Q4 2025 with revenue of about $11.3 billion, up 46% year-on-year and 22% sequentially, and a management-adjusted gross margin of 45.7%, with guidance for 50.5–52.5% next quarter.

What this means for Micron stock

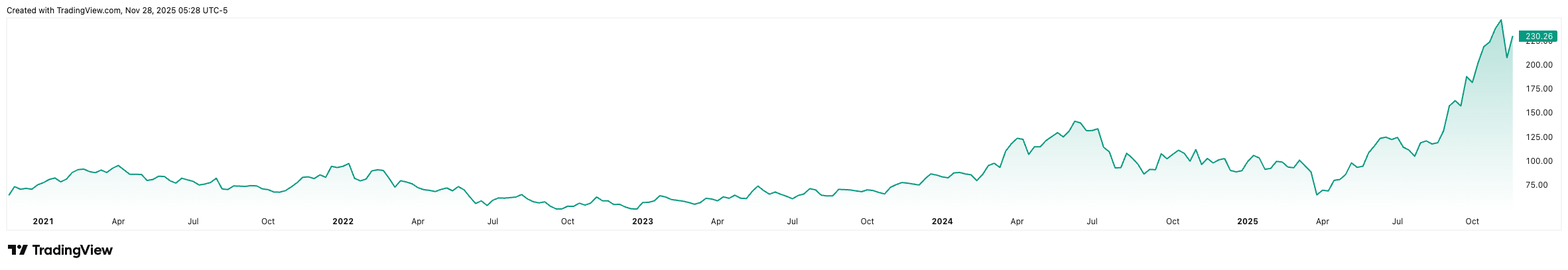

Micron stock has already re-rated on the back of these trends. By late November 2025, MU is up roughly 140–150% year-to-date, making it one of the strongest large-cap semiconductor names this year. Shares recently traded around $230, still about 11–12% below a 52-week high of $260.58 set earlier in November.

Analysts increasingly frame Micron as a core AI infrastructure stock rather than a purely cyclical memory name. Barron’s, for example, highlights that DRAM and NAND shortages plus AI demand could push Micron’s gross margins toward 60% and drive fiscal-2026 revenue into the mid-$60-billion range with EPS above $20, well ahead of earlier consensus. At the same time, S&P’s “positive” outlook signals that an actual rating upgrade is possible if AI demand and favourable industry supply conditions persist into 2027, which would lower Micron’s funding costs and support its elevated capex plan.

Micron Technology, Inc. stock performance over the last 5 years. (Source: tradingview.com)

Who else benefits from memory shortages?

Micron is not alone in benefiting from AI-driven memory shortages. Samsung Electronics and SK hynix dominate DRAM and HBM. SK hynix expects the AI-memory segment to grow roughly 30% per year through 2030, with custom HBM alone reaching “tens of billions” of dollars in annual sales. Industry forecasts see the global HBM market expanding from about $17 billion in 2024 to nearly $100 billion by 2030, a multi-year tailwind for all three HBM suppliers (SK hynix, Samsung, Micron).

Conclusion

AI-driven demand for DRAM and HBM, genuine supply constraints and a supportive credit backdrop have combined to put Micron in one of the strongest competitive and financial positions in its history. At the same time, the classic risks of the memory industry have not disappeared: a pause in AI capex, or an over-aggressive capacity build-out by Micron and its peers, could swing the market back toward oversupply later in the decade.

.jpg)

.jpg)