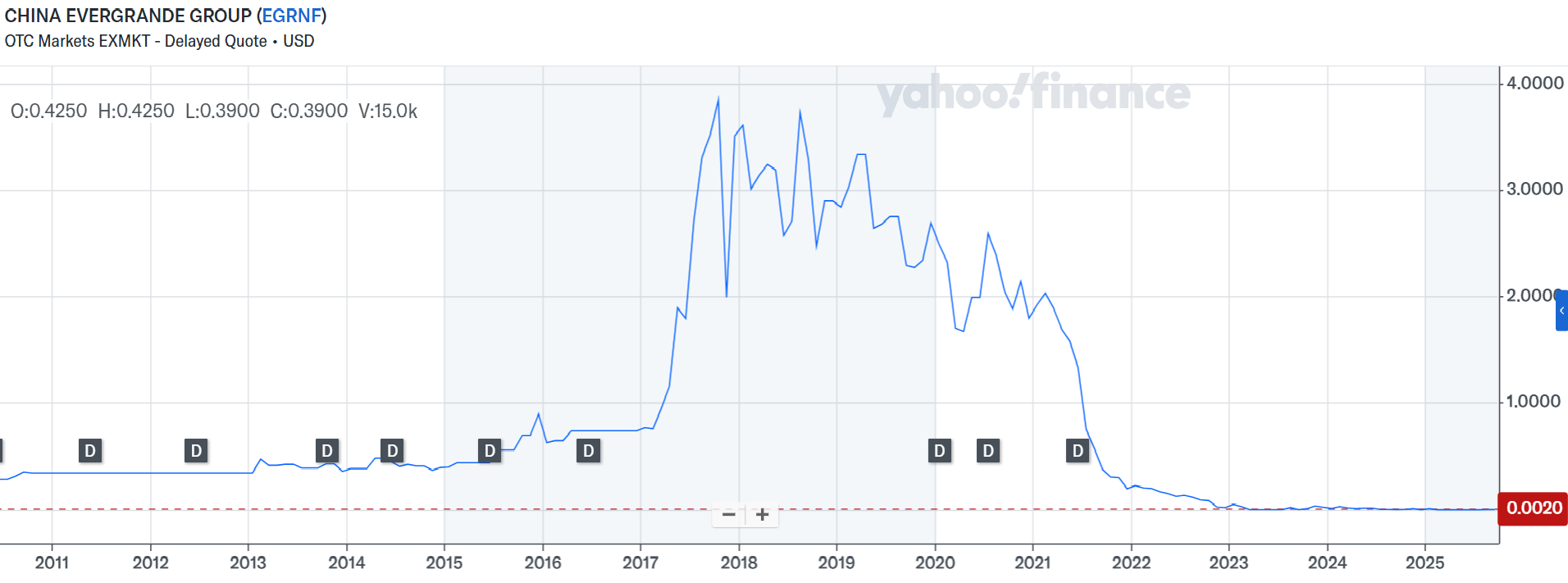

Source: Yahoo Finance

Delisting Finalized

Shares of China Evergrande Group were permanently cancelled from trading on the Hong Kong bourse. The move came after a court order earlier this year mandated the liquidation of the company, following its failure to repay more than $300 billion in liabilities or to submit a viable restructuring plan. For investors and analysts alike, the delisting marks one of the largest and most dramatic collapses in recent financial history.

Evergrande was first listed in Hong Kong in 2009, with an initial market value of $9 billion. Over the following decade, it surged to a peak valuation of $51 billion and became the world’s most indebted developer and a prominent symbol of China’s urban growth. Yet by the time trading was suspended in January 2024, its value had fallen to just $282 million. The company’s shares, once worth over HK$31 each, fell to a mere HK$0.163 before disappearing from the market.*

The Dangers of Debt-Fuelled Expansion

The company’s downfall tells a cautionary tale about debt-fuelled expansion in China’s real estate sector. Evergrande relied heavily on borrowing to finance aggressive growth, amassing projects across the country. When the government introduced stricter rules to curb property speculation and excess leverage, the developer’s fragile balance sheet quickly unraveled. Its inability to deliver homes to buyers and to service mounting debts exposed the structural weaknesses of an industry that had long been a pillar of China’s economy.

Analysts warn that Evergrande’s collapse is not an isolated incident. The broader property sector has been facing an unprecedented debt crisis since 2021, with several other developers struggling to avoid liquidation. Earlier this month, state-backed China South City became the latest firm to face a court-ordered liquidation, signaling that even government-supported developers are not immune to financial distress. The crisis has left countless projects unfinished, undermining consumer confidence and weighing heavily on household wealth.

Government Efforts to Revive Confidence

The Chinese government, aware that the property sector once contributed nearly a quarter of the nation’s GDP, has introduced stimulus measures to revive demand. However, analysts remain skeptical about whether these efforts can restore confidence among buyers and investors. But that is easier said than done, as reviving consumption demand and sentiment when people have empty pockets seems to be an impossible task.

Prolonged Liquidation Process and Its Costs

Meanwhile, Evergrande’s liquidation process is expected to drag on for years, if not decades. Liquidators have so far recovered only about $255 million in offshore assets, compared with creditor claims exceeding $45 billion. Former chairman Hui Ka Yan, once one of China’s richest men, has been fined, banned from securities markets, and remains under investigation for fraud. Efforts to reclaim dividends and executive payments from Hui and others are ongoing but unlikely to satisfy creditor demands.

For many homebuyers, the collapse is deeply personal. Thousands of families are still waiting for apartments they paid for, and many investors who purchased Evergrande’s wealth management products have little hope of recovering their money. Social media posts from disillusioned buyers echo a common sentiment: if the country’s largest developer can collapse, no one is safe.

* Past performance is no guarantee of future results.

.jpg)