Wages Turn Positive

For the first time in seven months, Japanese real wages have climbed into positive territory. In July, real wages rose by 0.5% year on year, powered by generous summertime bonuses, which jumped an impressive 7.9% according to the labour ministry. This boost not only raised take-home pay but also sent a positive signal to households and markets that companies are willing and able to reward workers even in a time of global uncertainty.

The timing of the increase matters. Households often adjust their spending patterns based on confidence in their income, and an upward shift in real wages can encourage more robust consumption. As disposable income rises, families feel more secure about making discretionary purchases, which in turn supports local businesses and fuels a broader economic cycle that benefits the entire country.

Beyond special payments, regular pay grew by 2.5% in July, the fastest increase in seven months. Overtime pay, a key gauge of business activity, rose 3.3%, reflecting demand for labour across sectors. Together, these gains suggest that companies are not only making one-off adjustments but are also adapting to a competitive labour market by raising wages more consistently.

Consumer Spending Extends Gains

Household spending grew by 1.4% year on year in July, marking its third consecutive month of expansion. This trend points to steady underlying demand despite price pressures, reinforcing the idea that households are adapting and maintaining economic activity. Even a modest but persistent rise in spending contributes significantly to GDP growth in a consumption-driven economy like Japan’s.

On a seasonally adjusted basis, spending climbed by 1.7% month on month, exceeding earlier estimates. Some of these increases reflect higher electricity bills and automobile expenses, but sustained growth suggests that households are not simply covering costs but also beginning to engage in more varied forms of consumption. This resilience is a vital ingredient for building momentum, especially as external factors such as global trade uncertainties continue to pose risks.

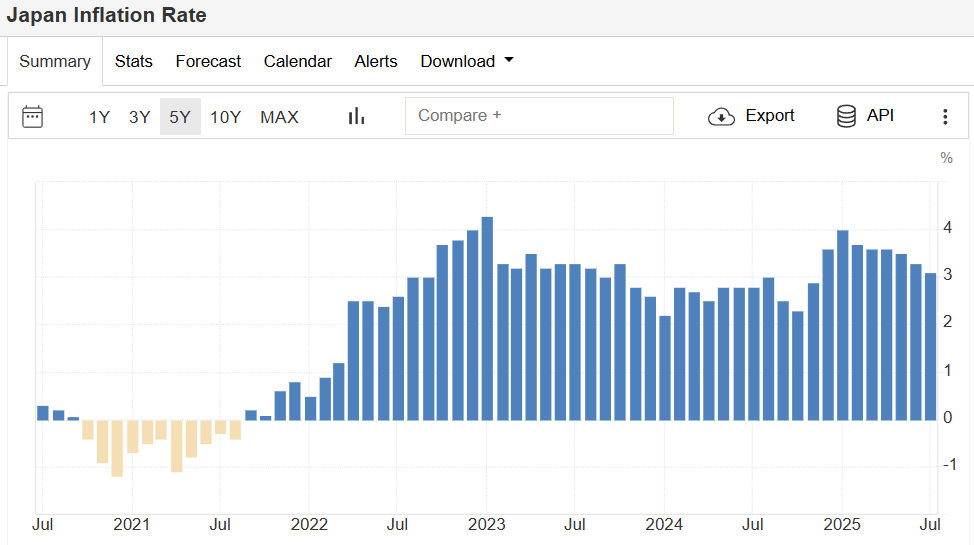

Source: Trading Economics

Inflation Still a Challenge but a Slowing One

Consumer inflation used in calculating real wages stood at 3.6% in July, still above the Bank of Japan’s 2% target. However, it rose at its slowest pace since November of last year, providing a hint that inflationary pressures are beginning to ease. For households, even a slight slowdown can relieve some pressure, enabling them to better plan spending and savings.

For policymakers, the combination of moderating inflation and rising wages offers a more balanced environment in which to make decisions. While analysts caution against prematurely raising interest rates, the evolving landscape could allow the BOJ to gradually shift its focus toward supporting sustainable growth without stifling economic momentum. Careful calibration will be key to preserving the benefits of wage gains while containing price risks.

.jpg)