Source: Yahoo Finance*

All-Positive Nvidia

Nvidia’s results can be summed up in one word — spectacular. The company reported a 15% increase in revenue from the previous quarter, a 122% increase from a year ago. Nvidia's revenue for the quarter reached $30.0 billion, surpassing the expected $28.7 billion. Earnings per share (EPS) came in at 68 cents, exceeding analysts' expectations of 65 cents and marking a 152% increase from the previous year.* Nvidia also forecasted third-quarter revenue of $32.5 billion, plus or minus 2%, compared to analysts' estimates of $31.8 billion.*

Revenue from cloud services hit a new record of $26.3 billion, up 16% from the previous quarter and 154% from a year ago. The gaming and AI PC segments generated $2.9 billion. Nvidia's gross margin was 75.7%, down from 78.9% in the previous quarter. For 2024, the full-year margin is expected to be in the mid-70% range. The company's share buyback program has been boosted by an additional $50 billion.

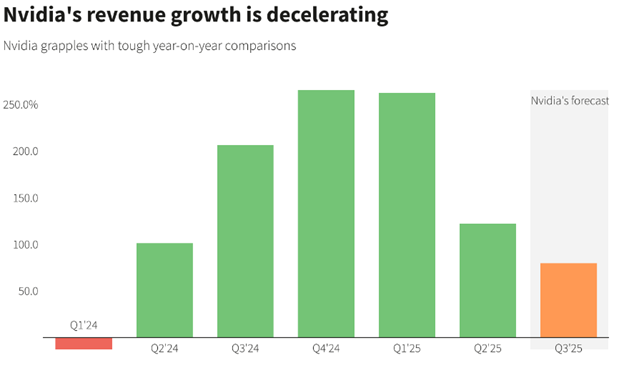

Despite these stellar results, the market reaction was mixed. Nvidia's shares fell 2.2% on Wednesday and an additional 5% on Thursday, primarily in post-market trading.* This marks a significant departure from the typical market response to such strong results. The explanation is straightforward: investors were expecting even higher revenue guidance and more impressive results. The immense pace of Nvidia’s revenue growth has been staggering, but the current quarter shows a slower increase compared to previous quarters, as illustrated by the following graphic.

Source: Reuters*

Note! Nvidia is using different fiscal year markings than calendar year

Positive Macroeconomic Trends in the US

This week, we also saw jobless claims for the previous week and a revision of the GDP in the United States. The number of new unemployment benefit claims decreased slightly by 2,000 to a seasonally adjusted 231,000. Economists polled by Reuters had forecasted 232,000 claims for the week, marking a slight improvement in an otherwise worsening US job market.

Economists expect the unemployment rate this month to either remain near a three-year high of 4.3% or fall to 4.2%. If it stays at 4.3% or higher, the Federal Reserve may consider decreasing interest rates in September by 50 basis points instead of 25.

The US gross domestic product (GDP) increased at an annualized rate of 3.0% in the second quarter, revised upwards from 2.8%. The economy grew at a 1.4% pace in the first quarter.

What Can We Expect in the Coming Months?

Nvidia’s results have shown that even the best-performing stocks can stumble despite favorable market and economic conditions. Therefore, the current situation can be interpreted as a hidden correction—a period when the stock market moves sideways despite strong fundamentals that would typically drive it higher. [1]

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

.jpg)